Understanding Land Value Tax: A Foundation for Berlin's Future

As Berlin's housing crisis continues, it's clear changes need to be made. One change I haven't seen get much attention is the Land Value Tax (LVT), an idea proposed by Henry George. I can see how a tax might not be very appealing, however a Land Value Tax is a surprisingly elegant idea that could help address some of our city's pressing issues. There's plenty of other descriptions of LVT online, but here's one more anyway!

What Is Land Value Tax (LVT)?

Land Value Tax is exactly what it sounds like: a tax on the value of land, independent of any buildings or improvements on it. While that might seem simple, this distinction from traditional property tax has profound implications for how our city could develop.

The Key Distinction: Land vs. Improvements

Imagine walking down a street in Kreuzberg and seeing two adjacent plots:

- One has a five-story apartment building housing multiple families

- The other is an empty lot, maybe used for parking or something

That building is an example of an "improvement", as could many things (parks, tennis courts, irrigation systems...)

Under current property tax systems, the apartment building owner pays significantly more tax than the empty lot owner. With LVT, both would pay the same tax because they occupy equally valuable land. This change creates strong incentives to use land more efficiently.

How Does It Work?

Interestingly, LVT is generally based on the rental income of land, rather than the purchase price of land itself. Let's break down the mechanics with a simple example:

- Land Value: A plot of land in a desirable area of Berlin might have a land value that would cost €100,000 per year to rent

- Tax Rate: With a 10% LVT, the owner would pay €10,000 annually

- Buildings Don't Matter: Whether there's a single-family home or a 50-unit apartment building, the tax remains the same

This system encourages putting valuable land to its best use, rather than leaving it vacant or underutilized.

Why It Matters for Berlin

There are some key advantages make LVT particularly relevant for our city:

1. Encourages Development Where It's Needed

Unlike property tax, LVT doesn't penalize building improvements. This could help address Berlin's housing shortage by encouraging development of vacant lots in high-demand areas, and further developing existing structures, all of which would increase supply.

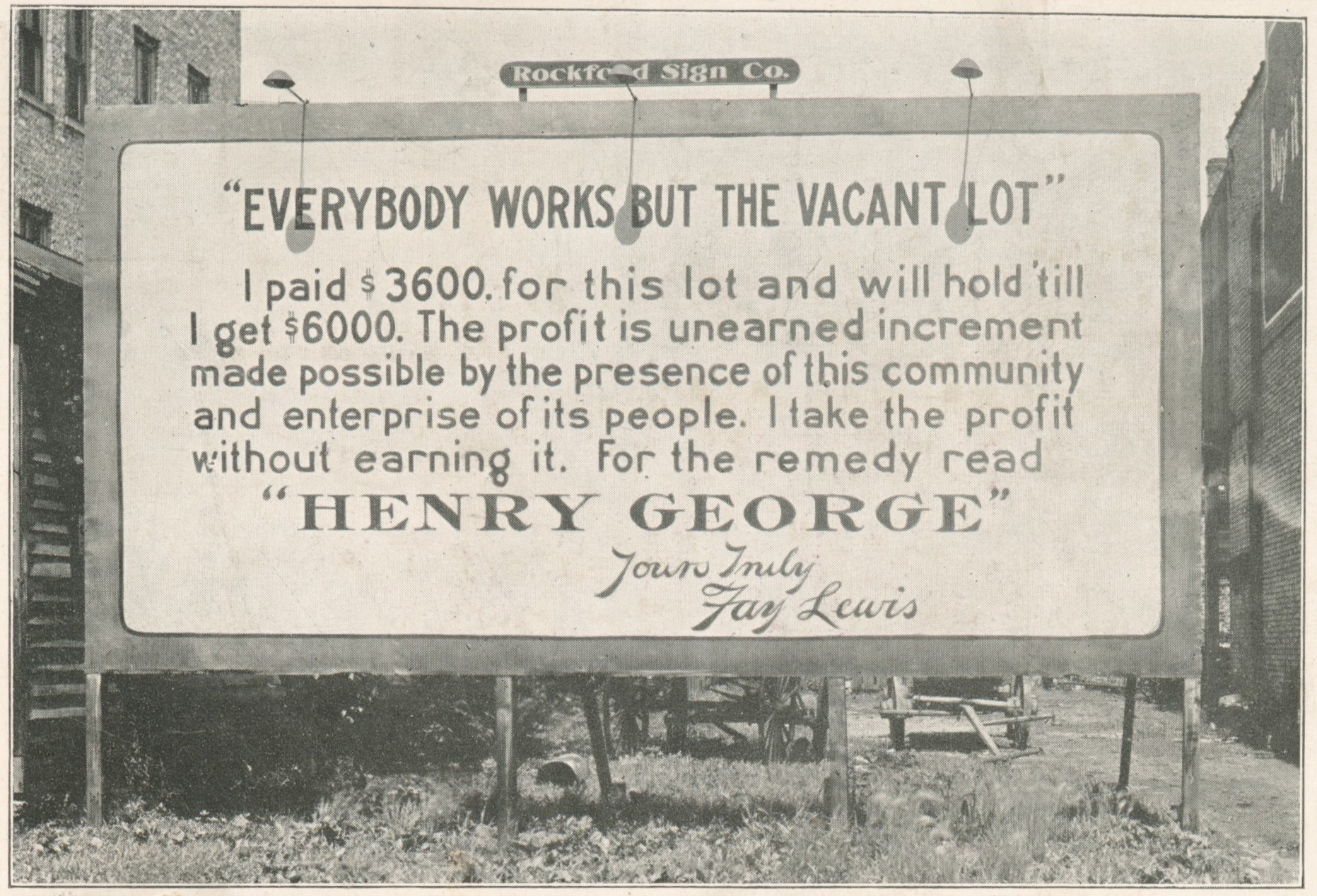

2. Reduces Speculation

In rapidly developing neighborhoods like Wedding or Lichtenberg, LVT would make it costly to hold empty lots waiting for prices to rise. This could help stabilize land prices and encourage steady, sustainable development.

3. Captures Community-Created Value

When a new U-Bahn station or park makes a neighborhood more desirable, that added land value comes from public investment and community development. LVT returns some of that community-created value to the public.

4. Could Replace Less Efficient Taxes

Taxes on income or business activity can discourage productive work. However since land is in fixed supply LVT has no negative impact on economic activity. Revenue from LVT could potentially replace or reduce other taxes that currently distort Berlin's economy. For example, reducing business taxes could make the city more attractive for startups and growing companies while maintaining public revenue through LVT.

Given how it doesn't have distortionary effects, Henry George went even further and proposed replacing all taxes with a single tax on land value, and returning that value to the community in the form of a basic income, called a Citizens Dividend!

Common Questions

"Isn't This Just Another Property Tax?"

No - and the difference is crucial. Property tax charges you more for building housing or businesses. LVT charges the same regardless of what you build, encouraging development rather than penalizing it.

"How Do You Determine Land Value?"

This is one of the key pratical challenges - one that deserves its own detailed exploration. Berlin already maintains detailed land value maps (Bodenrichtwerte) which could serve as a starting point. I plan to have future posts on this topic.

The Philosophy Behind It

Henry George, who popularized this idea in his book Progress and Poverty, made a compelling ethical case: While buildings are created by people, land value is largely created by either nature or the community. The desirability of land in Prenzlauer Berg or Kreuzberg comes from public infrastructure, cultural amenities, and the people of Berlin who made these neighborhoods vibrant. So LVT is a way to give that value back to the community that created it, which I find rather elegant.

Looking Ahead

This introduction scratches the surface of how LVT could work in Berlin. In future pieces, I'll explore:

- How Berlin's current property tax (Grundsteuer) system works

- Specific examples of how LVT might affect different Berlin neighborhoods

- Implementation challenges and potential solutions

- Lessons from cities that have implemented similar systems

Want to Learn More?

The links throughout lead to more resources you can explore to learn about LVT, Henry George, and Georgism. I'm also happy to discuss these topics further, so do feel free to get in touch! I'm particularly interested in hearing:

- Which aspects of LVT you'd like to understand better

- Specific concerns about how it might work in Berlin

- Examples of vacant or underutilized land in your neighborhood

This is part of a series exploring how Land Value Tax could help address Berlin's urban development challenges.